Condo Insurance in and around Greeley

Townhome owners of Greeley, State Farm has you covered.

Condo insurance that helps you check all the boxes

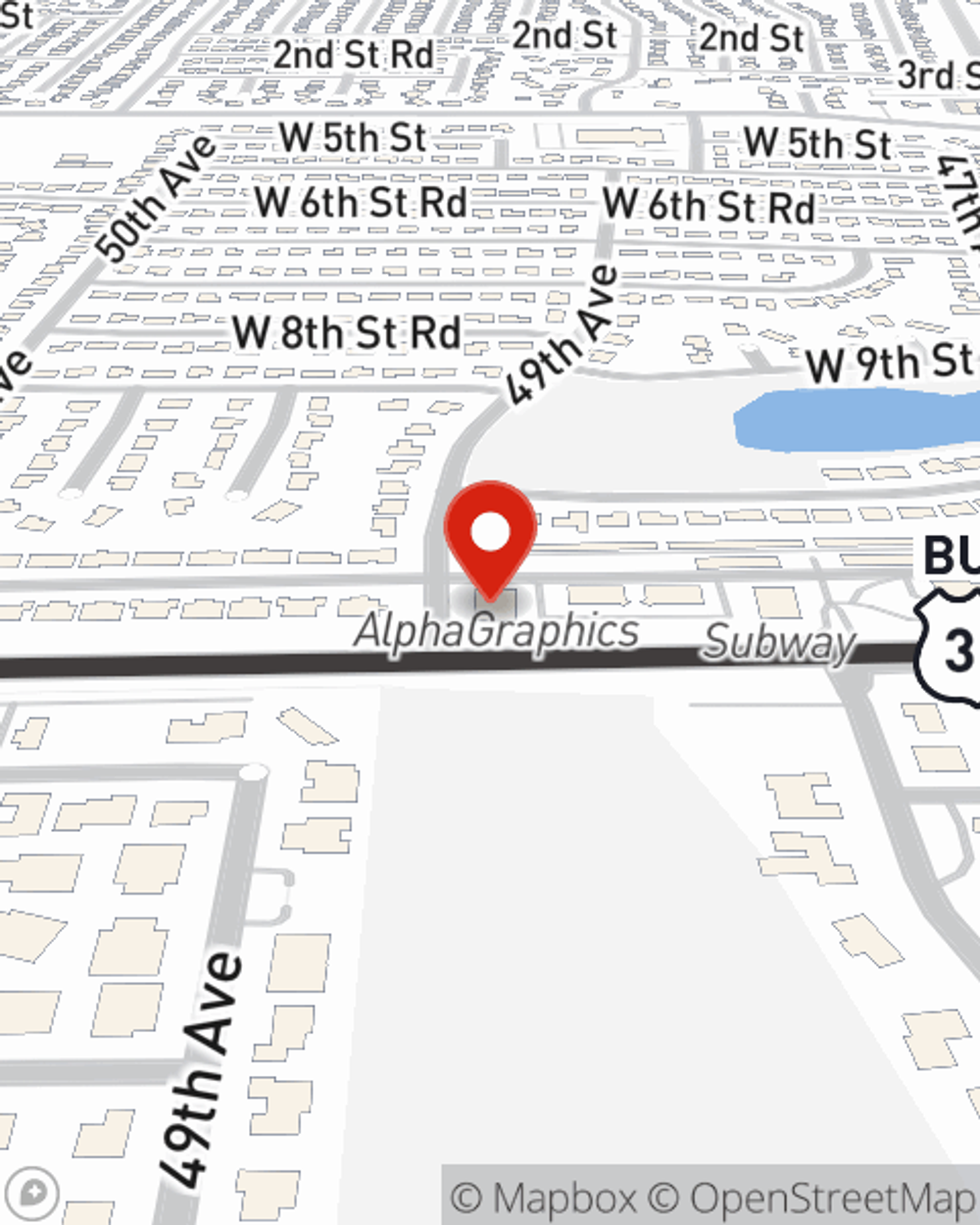

- Greeley

- Evans

- Windsor

- La Salle

- Eaton

- Loveland

- Fort Collins

- Ault

- Kersey

Your Belongings Need Coverage—and So Does Your Townhome.

Because your condo is your safe place, there are some key details to consider - future needs, location, needed repairs, and making sure you have the right protection for your home in case of the unexpected. That's where State Farm comes in to offer you great insurance options to help meet your needs.

Townhome owners of Greeley, State Farm has you covered.

Condo insurance that helps you check all the boxes

State Farm Can Insure Your Condominium, Too

With this insurance from State Farm, you don't have to be afraid of the unpredictable happening to your condo and its contents. Agent Mark Larson can help inform you of all the various options for you to consider, and will assist you in creating an excellent policy that's right for you.

Finding the right coverage for your condo is made easy with State Farm. There is no better time than today to get in touch with agent Mark Larson and check out more about your great options.

Have More Questions About Condo Unitowners Insurance?

Call Mark at (970) 356-8700 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Mark Larson

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.